UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement | |||

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |||

| ☒ | Definitive Proxy Statement | |||

| ☐ | Definitive Additional Materials | |||

| ☐ | Soliciting Material under Rule 14a-12 | |||

BARNES & NOBLE EDUCATION, INC.

(Name of registrant as specified in its charter)

(Name of person(s) filing proxy statement, if other than the registrant)

Payment of Filing Fee (Check the appropriate box):

| ☒ | No fee required. | |||

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. | |||

| (1) | Title of each class of securities to which transaction applies:

| |||

| (2) | Aggregate number of securities to which transaction applies:

| |||

| ||||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

| |||

| (4) | Proposed maximum aggregate value of transaction:

| |||

| (5) | ||||

| Total fee paid: | ||||

| ||||

| ☐ | Fee paid previously with preliminary materials. | |||

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| (1) | Amount Previously Paid:

| |||

| (2) | Form, Schedule or Registration Statement No.:

| |||

| ||||

| (3) | Filing Party:

| |||

| (4) | Date Filed:

| |||

120 Mountain View Blvd.

Basking Ridge, New Jersey 07920

August 17, 201715, 2019

Dear Stockholder:

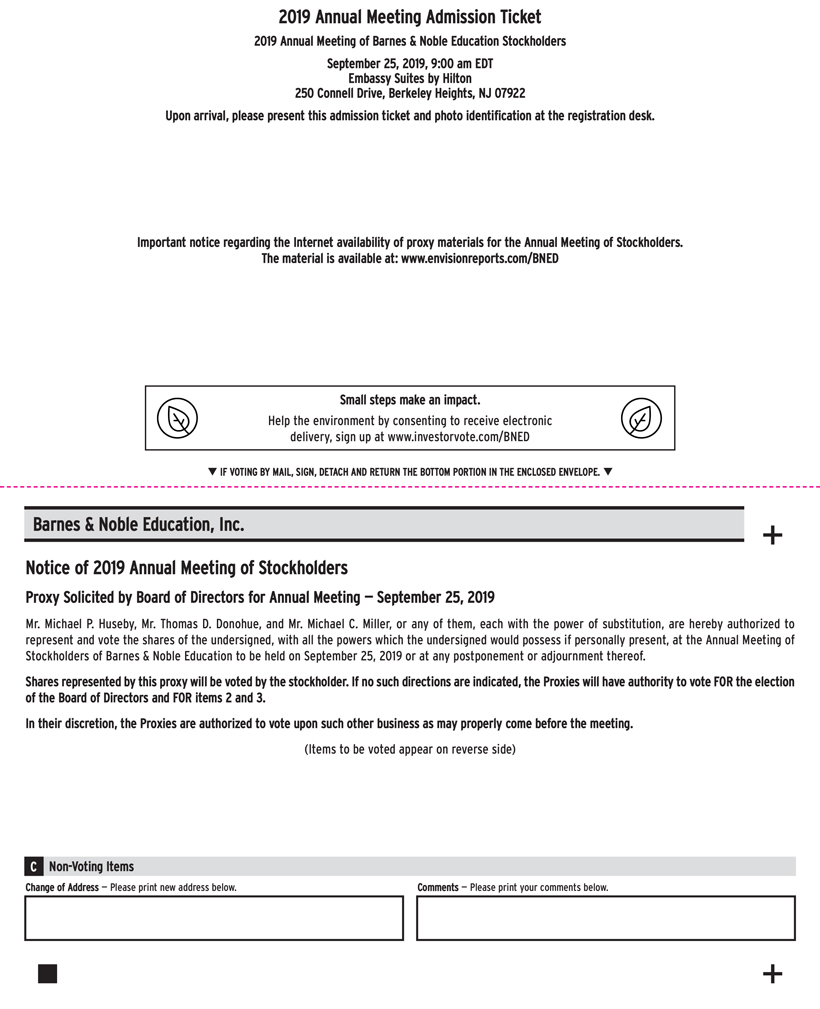

You are cordially invited to attend the 2017 annual meeting of stockholders of Barnes & Noble Education, Inc. (the “Company”) cordially invites you to attend the 2019 Annual Meeting of Stockholders (the “Annual Meeting”). The Annual Meeting will be held at 9:00 am, Eastern Time, on September 20, 201725, 2019 at Bridgewater Marriott, 700 Commons Way, Bridgewater,the Embassy Suites by Hilton, 250 Connell Dr., Berkeley Heights, NJ 08807 (the “Annual Meeting”).07922.

Information about the Annual Meeting and the various matters on which the stockholders will act is included in the Notice of Annual Meeting of Stockholders and the Proxy Statement which follow.Statement. Also included are a proxy card and postage-paid return envelope. The Proxies are being solicited on behalf of the Board of Directors of the Company.

You are urged to read the Proxy Statement carefully and, whether or not you plan to attend the Annual Meeting, to promptly submit a proxy: (a) by telephone or the Internet following the instructions on the enclosed proxy card or (b) by signing, dating and returning the enclosed proxy card in the postage-paid return envelope provided.

The Board of Directorsunanimously recommends that you vote (i)FOR the election of each of the Board of Directors’ nominees, (ii)FOR the amendment to the Amended and Restated Certificate of Incorporation to declassify the Board of Directors and provide for the annual election of directors beginning with the 2018 annual meeting of stockholders, (iii)FOR the approval, on an advisory basis, of the compensation of the Company’s named executive officers as disclosed in the Proxy Statement, and (iv) (iii)FOR the ratification of the appointment of Ernst & Young LLP as the independent registered public accountants for the Company’s fiscal year ending April 28, 2018.May 2, 2020.

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting of Stockholders to be held on September 20, 2017:25, 2019: The Proxy Statement and the Company’s 20172019 Annual Report to Stockholders are available online atwww.bned.com/investor.

Your vote is extremely important no matter how many shares you own. If you have any questions or require any assistance with voting your shares, please contact Barnes & Noble Education, Inc.’s proxy solicitor:

Innisfree M&A Incorporated

501 Madison Avenue, 20th20th Floor

New York, NY 10022

Stockholders may call toll-free: (888)750-5834

Banks and Brokers may call collect: (212)750-5833

| Sincerely, |

Michael P. Huseby

and Chief Executive Officer |

120 Mountain View Blvd.

Basking Ridge, New Jersey 07920

NOTICE OF THE ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON SEPTEMBER 20, 201725, 2019

The Annual Meeting of Stockholders of Barnes & Noble Education, Inc. (the “Company”) will be heldhold its Annual Meeting of Stockholders (the “Annual Meeting”) at 9:00 am, Eastern Time, on September 20, 201725, 2019 at Bridgewater Marriott, 700 Commons Way, Bridgewater,the Embassy Suites by Hilton, 250 Connell Dr., Berkeley Heights, NJ 0880707922 for the following purposes:

| 1. | To elect |

| 2. |

| To vote on an advisory(non-binding) vote to approve executive compensation; |

To ratify the appointment of Ernst & Young LLP as the independent registered public accountants for the Company’s fiscal year ending |

To transact such other business as may be properly brought before the Annual Meeting and any adjournment or postponement thereof. |

Only holders of record of common stock of the Company as of the close of business on August 2, 2017July 29, 2019 are entitled to notice of and to vote at the annual meetingAnnual Meeting and any adjournment or postponement thereof.

The Board of Directors unanimously recommends that you vote (i)FOR the election of each of the Board of Directors’ nominees, (ii)FOR the amendment to the Amended and Restated Certificate of Incorporation to declassify the Board of Directors and provide for the annual election of directors beginning with the 2018 annual meeting of stockholders, (iii)FOR the approval, on an advisory basis, of the compensation of the Company’s named executive officers as disclosed in the Proxy Statement, and (iv) (iii)FOR the ratification of the appointment of Ernst & Young LLP as the independent registered public accountants for the Company’s fiscal year ending April 28, 2018.May 2, 2020.

|

The Board of Directors urges you to read the Proxy Statement carefully and, whether or not you plan to attend the Annual Meeting, to promptly submit a proxy: (a) by telephone or the Internet following the instructions on the enclosedWHITE proxy card or (b) by signing, dating and returning the enclosedWHITE proxy card in the postage-paid return envelope provided.

Sincerely, |

Michael C. Miller |

| Corporate Secretary |

| Basking Ridge, New Jersey |

| August 15, 2019 |

| 22 | ||||

| 22 | ||||

| 23 | ||||

| 23 | ||||

Executive | ||||

Compensation Policies and Practices as Related to Risk Management | ||||

| 34 | ||||

Narrative to the Summary Compensation Table and the Grants of Plan-Based Awards Table | ||||

Employment | ||||

Employment | ||||

Employment | ||||

| 39 | ||||

| 43 | ||||

| 43 | ||||

| 43 | ||||

| 44 | ||||

| ||||

PROPOSAL | 47 | |||

PROPOSAL | 48 | |||

| 49 | ||||

| 50 | ||||

| 50 | ||||

| 50 | ||||

| 50 | ||||

| 50 | ||||

The following summary highlights information relating to the 20172019 annual meeting of stockholders (the “Annual Meeting”) and executive compensation and corporate governance matters. Additional information is included in this Proxy Statement.

20172019 Annual Meeting of Stockholders for Barnes & Noble Education, Inc.

General Information

| ||

September (Eastern Time) | ||

| Place |

| |

| Record Date | ||

Voting Matters and Recommendations

| ||

| Voting Matter | Board of Directors Recommendations | |

| Election of | FOR ALL NOMINEES | |

| Vote in an advisorynon-binding capacity to approve | FOR | |

| Ratification of Ernst & Young LLP as the independent registered public accountants for the Company’s fiscal year ending | FOR | |

The Board of Directors and management believe that good corporate governance promotes accountability to stockholders, enhances investor confidence in the Company and supports long-term value creation. The Company has implemented and fostered a culture of good corporate governance, which includes the following:

Governance Highlights | ||

✓ We

✓ None of our Director nominees serve on an excessive number of

✓ The Board of Directors follows Corporate Governance Guidelines

✓ Each committee of our Board of Directors has a published charter that is reviewed and discussed at least annually

✓ We have adopted a Corporate Social Responsibility Policy

✓ The Board of Directors has a Lead Independent Director | ✓ We are committed to maintaining an active dialogue with our stockholders. Over the past year, we have reached out to stockholders owning approximately

✓ Each committee of our Board of Directors is 100% comprised of independent Directors

✓ Independent Directors and Board of Director committees meet regularly and frequently without management present

✓ Our Corporate Governance and Nominating Committee oversees our Board of Directors’ annual self-evaluation | |

The Board of Directors and management seek to align the executive compensation program with the Company’s business strategy to attract, retain, and engage the talent we need to compete in our industry, and to align management with stockholders’ interests. The table below highlights key aspects of our executive compensation program.

Executive Compensation Highlights | ||

✓ A majority of executive pay is tied to performance-based and equity incentives ✓ Equity awards to our Chief Executive Officer and, for Fiscal Year 2020, to our other named executive officers and other members of senior management are at least 50% performance based ✓ Performance-based equity awards are earned over atwo-year performance period and are subject to an additional one year time-based vesting period

✓

✓ Incentive awards granted are subject to clawback and/or recoupment policies under the Equity Incentive Plan and Executive Incentive Compensation Clawback Policy

✓ Long-term incentives comprise a significant portion of target compensation for executive officers

✓ The vesting of awards that are assumed or substituted in connection with a change in control only accelerates as a result of the change in control if a participant experiences a qualifying termination of employment | ✓ Restricted stock awards are generally subject to aone-year minimum vesting period

✓ The

✓ Named executive officers are only entitled to limited perquisites

✓

✓ The Equity Incentive Plan prohibits the repricing of awards without stockholder approval ✓ Equity awards granted to executive officers in Fiscal 2019 and 2020 were decreased to reduce run rate | |

BARNES & NOBLE EDUCATION, INC.

120 Mountain View Blvd.

Basking Ridge, New Jersey 07920

PROXY STATEMENT FOR THE ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON SEPTEMBER 20, 201725, 2019

This Proxy Statement and enclosed proxy card are being furnished commencing on or about August 17, 201715, 2019 in connection with the solicitation by the Board of Directors (the “Board of Directors”) of Barnes & Noble Education, Inc., a Delaware corporation (the “Company”), of proxies for use at its annual meeting of stockholders to be held on September 20, 201725, 2019 (the “Annual Meeting”), and any adjournment or postponement thereof for the purposes set forth in the accompanying Notice of Annual Meeting of Stockholders.

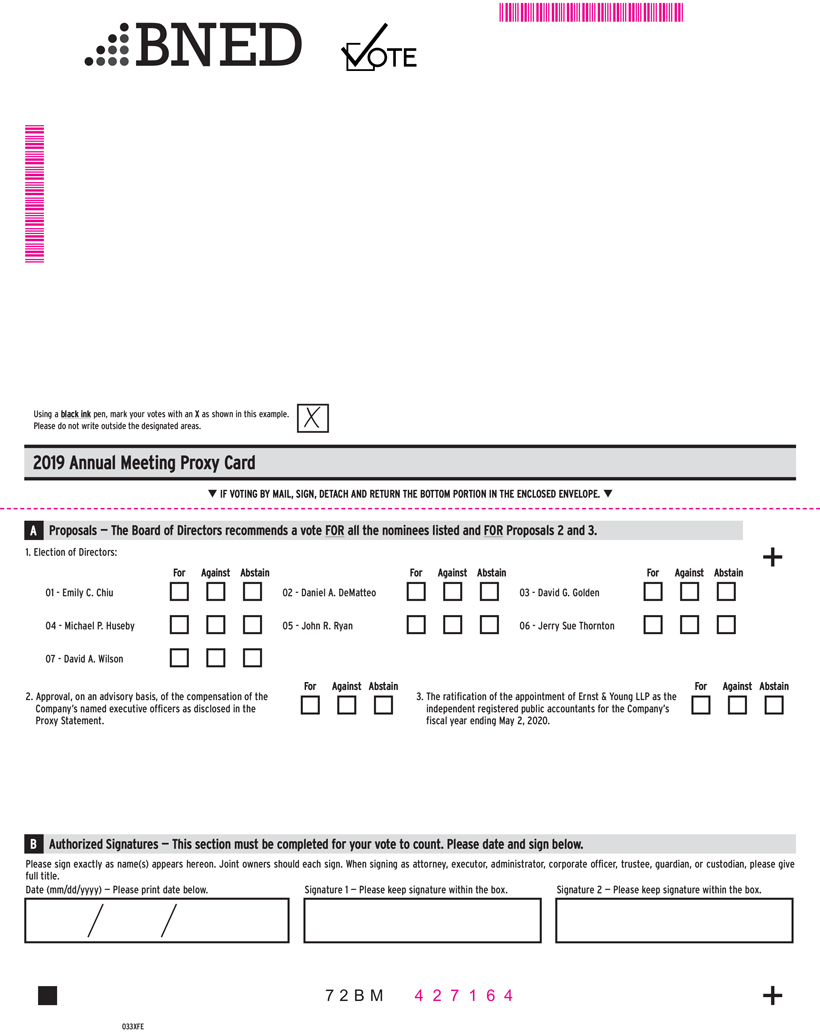

The Board of Directors unanimously recommends that you vote (i) FOR the election of each of the Board of Directors’ nominees, (ii) FOR the amendment to the Amended and Restated Certificate of Incorporation to declassify the Board of Directors and provide for the annual election of directors beginning with the 2018 annual meeting of stockholders, (iii) FOR the approval, on an advisory basis, of the compensation of the Company’s named executive officers as disclosed in the Proxy Statement, and (iv)(iii) FOR the ratification of the appointment of Ernst & Young LLP as the independent registered public accountants for the Company’s fiscal year ending April 28, 2018.May 2, 2020.

Only holders of record of the Company’s common stock, par value $0.01 per share (“Common Stock”), as of the close of business on August 2, 2017July 29, 2019 are entitled to notice of and to vote at the Annual Meeting. As of the record date, 46,516,89047,607,394 shares of Common Stock were outstanding. Each share of Common Stock entitles the record holder thereof to one vote on each matter brought before the Annual Meeting.

Your vote is very important to the Board of Directors no matter how many shares of our Common Stock you own. Whether or not you plan to attend the Annual Meeting, we urge you to vote your shares as soon as possible.

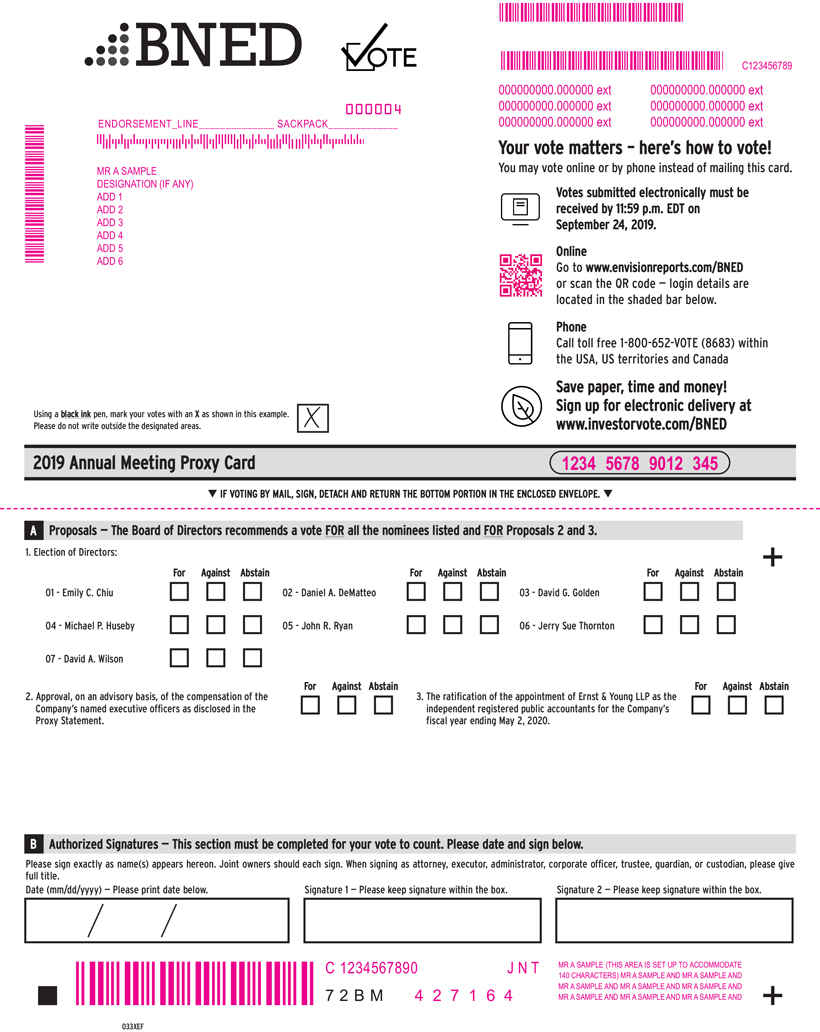

If You Are a Registered Holder of Common Stock

If you are a registered holder of Common Stock, you may vote your shares either by voting by proxy in advance of the Annual Meeting or by voting in person at the Annual Meeting. By submitting a proxy, you are legally authorizing another person to vote your shares on your behalf. We urge you to use the enclosed proxy card to vote (i) FOR the election of each of the Board of Directors’ nominees, (ii) FOR the amendment to the Amended and Restated Certificate of Incorporation to declassify the Board of Directors and provide for the annual election of directors beginning with the 2018 annual meeting of stockholders, (iii) FOR the approval, on an advisory basis, of the compensation of the Company’s named executive officers as disclosed in the Proxy Statement, and (iv)(iii) FOR the ratification of the appointment of Ernst & Young LLP as the independent registered public accountants for the Company’s fiscal year ending April 28, 2018.May 2, 2020. If you submit your executed proxy card or otherwise vote by telephone or by the Internet, your shares will be voted in accordance with your instructions; however, if you do not indicate how your shares are to be voted, then your shares will be voted in accordance with the Board of Directors’ recommendations set forth in this Proxy Statement. In addition, if any other matters are brought before the Annual Meeting (other than the proposals contained in this Proxy Statement), then the individuals listed on the proxy card will have the authority to vote your shares on those other matters in accordance with their discretion and judgment.

Whether or not you plan to attend the Annual Meeting, we urge you to promptly submit a proxy: (a) by telephone or the Internet following the instructions on the enclosed proxy card or (b) by signing, dating and returning the enclosed proxy card in the postage-paid return envelope provided. If you later decide to attend the Annual Meeting and vote in person, that vote will automatically revoke any previously submitted proxy.

If You Hold Your Shares in “Street Name”

If you hold your shares in “street name”, i.e., through a bank, broker or other holder of record (a “custodian”), your custodian is the stockholder of record for purposes of voting and is required to vote your shares on your behalf in accordance with your instructions. If you do not give instructions to your custodian, your custodian will not be permitted to vote your shares with respect to“non-discretionary” items, which includes all matters on the agenda other than the ratification of the appointment of the independent registered public accountants. A “brokernon-vote” occurs when a custodian does not vote on a particular proposal because it has not received voting instructions from the applicable beneficial owner and does not have discretionary voting power on the matter in question pursuant to New York Stock Exchange (“NYSE”) rules. Accordingly, we urge you to promptly give instructions to your custodian to vote FOR all items on the agenda by using the voting instruction card provided to you by your custodian. Please note that if you intend to vote your shares held in street name in person at the Annual Meeting, you must obtain a “legal proxy” from your custodian and provide it at the Annual Meeting.

If you have any questions or require any assistance with voting your shares, please contact the Company’s proxy solicitor:

Innisfree M&A Incorporated

501 Madison Avenue, 20th Floor

New York, NY 10022

Stockholders may call toll-free: (888)750-5834

Banks and Brokers may call collect: (212)750-5833

The presence in person or by proxy at the Annual Meeting of the holders of shares of Common Stock of the Company having a majority of the voting power of the Common Stock entitled to vote at the Annual Meeting will constitute a quorum. Withheld votes, abstentions and any “brokernon-votes” will be included in determining whether a quorum is present.

Votes Required and Treatment of Withheld Votes, Abstentions and BrokerNon-Votes

The two nominees for director receiving the highest vote totals willDirectors shall be elected as directors of the Company.

Approval of the amendment to the Amended and Restated Certificate of Incorporation to declassify the Board of Directors and provide for the annual election of directors beginning with the 2018 annual meeting of stockholders requires the affirmative vote ofby a majority of outstanding shares of Common Stockthe votes cast by the stockholders entitled to vote thereon who are present in person or represented by proxy at the Annual Meeting. Abstentions and broker non-votes are not considered votes cast for the foregoing purpose and will have no effect on this matter.the election of nominees.

AsWith respect to the proposal regarding approval, on an advisory vote, the approvalbasis, of the compensation of the Company’s named executive officers, is not binding. However, the Company will consider the affirmative vote of a majority of the votes cast on the proposal as approval of the compensation of the Company’s named executive officers (“NEOs”). Abstentions and brokernon-votes will not be included in the votes cast on this proposal and will not have a positive or negative effect on the outcome of this proposal.

Approval of the proposal to ratify the appointment of Ernst & Young LLP as the Company’s independent registered public accountants requires the affirmative vote of a majority of the votes cast on the proposal.

Withheld Votes, Abstentions and BrokerNon-Votes

With respect to the proposal to elect directors, withheld votes and any “brokernon-votes” are not counted in determining the outcome of the election. A “brokernon-vote” occurs when a custodian does not vote on a particular proposal because it has not received voting instructions from the applicable beneficial owner and does not have discretionary voting power on the matter in question.

With respect to the proposal to approve the amendment to the Amended and Restated Certificate of Incorporation to declassify the Board of Directors, “brokernon-votes” and abstentions will have the same effect as a vote against the proposal.

With respect to the proposal regarding approval, on an advisory basis, of compensation of the Company’s named executive officers, abstentions and any “brokernon-votes” will not be included in the votes cast and, as such, will have no effect on the outcome of this proposal.

With respect to the proposal to ratify the appointment of Ernst & Young LLP as the Company’s independent registered public accountants, abstentions will not be included in the votes cast and, as such, will have no effect on the outcome of this proposal.

Withheld votes, abstentions and any “brokernon-votes” will be included in determining whether a quorum is present.

Attendance at the Annual Meeting

Attendance at the Annual Meeting or any adjournment or postponement thereof will be limited to stockholders of the Company as of the close of business on the record date and guests of the Company. If you are

a stockholder of record, your name will be verified against the list of stockholders of record prior to your admittance to the Annual Meeting or any adjournment or postponement thereof. Please be prepared to present photo identification for admission. If you hold your shares in street name, you will need to provide proof of beneficial ownership, such as a brokerage account statement, a copy of a voting instruction form provided by your custodian with respect to the Annual Meeting, or other similar evidence of ownership, as well as photo identification, in order to be admitted to the Annual Meeting. Please note that if you hold your shares in street name and intend to vote in person at the Annual Meeting, you must also provide a “legal proxy” obtained from your custodian.

Your proxy is revocable. The procedure you must follow to revoke your proxy depends on how you hold your shares.

If you are a registered holder of Common Stock, you may revoke a previously submitted proxy by submitting another valid proxy (whether by telephone, the Internet or mail) or by providing a signed letter of revocation to the Corporate Secretary of the Company before the closing of the polls at the Annual Meeting. Only the latest-dated validly executed proxy will count. You also may revoke any previously submitted proxy and vote your shares in person at the Annual Meeting; however, simply attending the Annual Meeting without taking one of the above actions will not revoke your proxy.

If you hold shares in street name, in general, you may revoke a previously submitted voting instruction by submitting to your custodian another valid voting instruction (whether by telephone, the Internet or mail) or a signed letter of revocation. Please contact your custodian for detailed instructions on how to revoke your voting instruction and the applicable deadlines.

On July 19, 2017, Max J. Roberts resigned as Chief Executive Officer of the Company and tendered his resignation as a member of the Board of Directors of the Company, each effective as of September 19, 2017. On July 19, 2017, the Board of Directors appointed Michael P. Huseby, the Company’s Executive Chairman, to the position of Chief Executive Officer and Chairman of the Board of Directors, effective September 19, 2017.

PROPOSAL ONE: ELECTION OF DIRECTORS

The Board of Directors currently consists of seven directors. The directors are divided into three classes, consisting of three Class II directors, Max J. Roberts, who is resigning effective September 19, 2017, and David G. Golden and Jerry Sue Thornton, whose terms expire at the Annual Meeting, two Class III directors, Daniel A. DeMatteo and John R. Ryan, whose terms expire at the 2018 annual meeting of stockholders, and two Class I directors, Michael P. Huseby and David A. Wilson, whose terms expire at the 2019 annual meeting of stockholders. In connection with Mr. Roberts’ resignation from the Board of Directors, Mr. Golden and Ms. Thornton are the only two Class II directors who have been nominated forre-election, and, as a result of the vacancy, the Board of Directors has chosen to reduce its size from seven to six directors.

At the Annual Meeting, stockholders are being asked to vote on a proposal (Proposal Two) to amendPer the Company’s Amended and Restated Certificate of Incorporation, all seven of the current directors are standing forre-election, each to declassifyserve aone-year term. The Company strives to maintain a board with broad and diverse experience and judgment. The grid below summarizes the key qualifications, skills and attributes each of our directors possesses that were most relevant to the decision to nominate him or her to serve on the Board. The lack of a mark does not mean the director does not possess that qualification or skill; rather a mark indicates a specific area of focus or expertise on which the Board relies most heavily. Our director nominees exhibit high integrity, innovative thinking, a proven record of Directorssuccess, and provide for the annual electionknowledge of directors beginning with the 2018 annual meetingcorporate governance. The director nominees bring a balance of stockholders (the “Declassification Amendment”). If the Declassification Amendment is approved by stockholders, in orderimportant skills to make the declassification of the Board of Directors effective at the 2018 annual meeting of stockholders, each member of our Board of Directors whose term does not expire at the 2018 annual meeting (the Class I and Class II directors) will resign and bere-appointed to a term that will expire at the 2018 annual meeting of stockholders. All six directors will then stand for election to aone-year term at the 2018 annual meeting of stockholders. If Proposal Two is not approved, directors will continue to be elected and serve for three year terms. For more information about the Declassification Amendment, please see “Proposal Two: Approval of an Amendment to Amended and Restated Certificate of Incorporation to Provide for Annual Election of All Directors.”boardroom.

| Skills and Attributes | Chiu | DeMatteo | Golden | Huseby | Ryan | Thornton | Wilson | ||||||||||||||||||||||||||||

Academia / Education | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ||||||||||||||||||||||||||||

Business Operations | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ||||||||||||||||||||||||||||

CEO and Executive | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | |||||||||||||||||||||||||||||

Commercial Business | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | |||||||||||||||||||||||||||||

Corporate Governance | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ||||||||||||||||||||||||||||

Customer Engagement / Marketing | ✓ | ✓ | ✓ | ✓ | ✓ | ||||||||||||||||||||||||||||||

Data Analytics | ✓ | ✓ | |||||||||||||||||||||||||||||||||

Defense Industry or Military | ✓ | ||||||||||||||||||||||||||||||||||

Digital /e-Commerce | ✓ | ✓ | ✓ | ✓ | ✓ | ||||||||||||||||||||||||||||||

Financial / Investment | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | |||||||||||||||||||||||||||||

Government / Public Policy | ✓ | ✓ | |||||||||||||||||||||||||||||||||

International Business | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | |||||||||||||||||||||||||||||

Knowledge of Company Business | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ||||||||||||||||||||||||||||

Other Public Board | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | |||||||||||||||||||||||||||||

Other Relevant Industry | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ||||||||||||||||||||||||||||

Science, Technology, and Innovation | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | |||||||||||||||||||||||||||||

Information Concerning the Directors and the Board of Directors’ Nominees

Background information with respect to the Board of Directors and the Board of Directors’ nominees for election as directors appears below. See “Security Ownership of Certain Beneficial Owners and Management” for information regarding such persons’ holdings of equity securities of the Company.

| Name | Age | Director Since | Position | Age | Director Since | Position | ||||||

Nominees for Election at the Annual Meeting | Nominees for Election at the Annual Meeting | Nominees for Election at the Annual Meeting | ||||||||||

Emily C. Chiu* | 36 | 2018 | Director | |||||||||

Daniel A. DeMatteo* | 71 | 2015 | Director | |||||||||

David G. Golden* | 59 | 2015 | Director | 61 | 2015 | Director | ||||||

Michael P. Huseby | 64 | 2015 | Chairman of the Board | |||||||||

John R. Ryan* | 74 | 2015 | Director | |||||||||

Jerry Sue Thornton* | 70 | 2015 | Director | 72 | 2015 | Director | ||||||

Other Directors | ||||||||||||

Daniel A. DeMatteo* | 69 | 2015 | Director | |||||||||

Michael P. Huseby | 62 | 2015 | Executive Chairman | |||||||||

David A. Wilson* | 76 | 2015 | Director | 78 | 2015 | Director | ||||||

John R. Ryan* | 72 | 2015 | Director | |||||||||

| * | Independent for purposes of the |

At the Annual Meeting, two directors will be elected as Class II directors. David G. Golden and Jerry Sue Thornton are the Board of Directors’ nominees for election as directors at the Annual Meeting, each to hold office for a term of three years until the annual meeting of stockholders to be held in 2020 and until his or her successor is elected and qualified; however, if Proposal Two is approved, each of these directors intends to submit a resignation and be appointed to a term ending at the 2018 annual meeting of stockholders as described under “Proposal Two: Approval of an Amendment to Amended and Restated Certificate of Incorporation to Provide for Annual Election of All Directors.” Both of the nominees have consented to be named in this Proxy Statement and to serve on the Board of Directors, if elected. However, if either nominee is unable to serve or for good cause will not serve, proxies may be voted for a substitute designated by the Board of Directors.

Nominees for Election as Director

The following individuals are nominees for director at the Annual Meeting. The Board of Directors unanimously recommends a voteFOR each of the below nominees for director using the enclosed proxy card.

Emily C. Chiu was elected to the Board of Directors in June 2018. Ms. Chiu is a Strategic Development Principal at Square, Inc. (“Square”), where she oversees innovation for Square’s Cash App, an ecosystem of financial tools for individuals and sellers. Cash App is changing how people manage their money by providing easy ways to send, spend, and store funds. It has been the number one free finance app in the U.S. App Store for the past two years, and is consistently a top 20 free app, with mainstream adoption amongst tens of millions of engaged customers. Ms. Chiu is responsible for overseeing the vision, strategy, development, and commercialization of next-generation digital products and businesses to serve over 15 million monthly active users on the Cash App platform. Since she joined Square in July 2017, Ms. Chiu has also led Square’s corporate development strategy and acquisition and integration activities across Square’s SMB (Seller),direct-to-consumer (Cash App), and developer platform businesses. From July 2015 to July 2017, Ms. Chiu was a Partner and Head of Corporate Development at 500 Startups, LLC, a global startup accelerator and venture capital firm. In this role, Ms. Chiu led venture capital investments in the education technology space and founded 500 Startups’ M&A practice, advising entrepreneurs across a portfolio of over 2,000 startups in 60 countries. Prior to this, Ms. Chiu was a founding team member at UniversityNow, Inc., an education technology startup whose mission is to make higher education affordable and accessible through its digital learning platform and accredited universities that offer associate, bachelor’s, and master’s degree programs without student loan debt. From 2011 to 2015, Ms. Chiu served as Vice President of Operations and Strategic Development at UniversityNow, where she built the company’s operations from the ground up and led initiatives that scaled its platform to serve students worldwide, earning recognition fromEDUCAUSE and The Bill & Melinda Gates Foundation as a “breakthrough model in college completion”. Previously, Ms. Chiu served as the Head of Operations at TEDx San Francisco, an affiliate of TED devoted to “ideas worth spreading”. Before this, Ms. Chiu was a private equity investor at GI Partners, a global investment firm with over $17 billion in capital under management across private equity and real estate strategies. Ms. Chiu started her career at Goldman Sachs & Co., where she worked on mergers and acquisitions and financing transactions across Goldman’s technology and healthcare investment banking groups. Since March 2016, Ms. Chiu has served on the Board of Governors of the Center for Creative Leadership, a provider of executive education focused on leadership development, and is a member of its Executive Committee. Ms. Chiu is a graduate of The Wharton School of Business and the College of Arts &

Sciences at the University of Pennsylvania, where she was a Wharton Research Scholar and member of The Huntsman Program in International Studies and Business.

Qualifications, Experience, Attributes and Skills. Ms. Chiu has more than 15 years of experience across the technology, education, and financial services industries. Ms. Chiu’s experience as a technology investment banker at Goldman Sachs included significant work with mergers, acquisitions, and financing transactions. Ms. Chiu’s subsequent experience as a private equity and venture capital investor involved principal investing and advisory roles that spanned company stages and strategies — from control-oriented investments to transform the business models of established companies to early-stage venture investments to scale innovative technology startups. As Head of Corporate Development at 500 Startups, Ms. Chiu advised startups across 60 countries on growth, fundraising, and exit strategies. As an operator in the EdTech space, Ms. Chiu built UniversityNow’s business from the ground up and was responsible for strategic initiatives that scaled its accredited online universities and digital learning platform to serve students worldwide. In her current role at Square, Ms. Chiu is responsible for innovation: conceptualizing, building, and scaling next-generation consumer products and digital businesses to serve tens of millions of customers. Prior to this, Ms. Chiu was responsible for leading mergers and acquisitions strategy, execution, and integration at Square, with a focus on driving technology and business transformation through inorganic strategies. Ms. Chiu brings to the Board of Directors relevant industry background, operating experience spanning organic and inorganic strategies, expertise in digital content and innovation, as well as anin-depth understanding of the impact of technology and digital transformation on business models.

Daniel A. DeMatteo was elected as a director in August 2015. Mr. DeMatteo has served as Gamestop Corp.’s Director and Executive Chairman since June 2010, and previously held other roles with Gamestop, including Chief Executive Officer from August 2008 to June 2010, Vice Chairman and Chief Operating Officer from March 2005 to August 2008, and President and Chief Operating Officer of Gamestop or its predecessor companies since November 1996. Mr. DeMatteo has served as an executive officer in the video game industry since 1988.

Qualifications, Experience, Attributes and Skills. Mr. DeMatteo brings to the Board of Directors over 25 years of experience as an executive officer, including 19 years of experience growing Gamestop and its predecessor companies into the world’s largest multichannel video game retailer. As one of the founders of Gamestop, Mr. DeMatteo has demonstrated a record of leadership, innovation and achievement. With his experience in the roles of Executive Chairman, Vice Chairman, Chief Executive Officer, President and Chief Operating Officer, Mr. DeMatteo provides the Board of Directors a unique and valuable perspective on corporate operations, strategy and business, including his perspective on the formula for success that has brought Gamestop to its current industry-leading position. The Board of Directors also benefits from Mr. DeMatteo’s entrepreneurial spirit and his extensive network of contacts and relationships within the retail industry.

David G. Golden was elected as a director in August 2015. Mr. Golden served as a director of Barnes & Noble, Inc. (“Barnes & Noble”) from October 2010 until the Company’s separation from Barnes & Noble in August 2015 (the “Spin Off”). Mr. Golden has been a Managing Partner at Revolution Ventures, an early-stage venture affiliate of Revolution LLC, since January 2013. From March 2006 until December 2011, Mr. Golden was a Partner, Executive Vice President and Strategic Advisor at Revolution LLC, a private investment company. Mr. Golden also served as Executive Chairman of Code Advisors, a private merchant bank focused on the intersections of technology and media from its founding in 2010 through 2012. Previously, Mr. Golden served in various senior positions over an18-year period, including as Vice Chairman and Global Director of the Technology, Media and Telecom investment banking group, at JPMorgan Chase & Co. (“JPMorgan”), a financial services firm, and a predecessor company, Hambrecht & Quist, Inc. (“Hambrecht & Quist”). Prior to that, Mr. Golden worked as a corporate attorney at Davis Polk & Wardwell LLP. Mr. Golden ishas previously served as a member of the Board of Directors of Blackbaud, Inc., and Everyday Health, where he currently servesalso served on itstheir respective Audit Committee.Committees. Mr. Golden also is a member of the Advisory Board of Directors of Granite Ventures LLC, a technology venture capital firm, andfor Partners for Growth LLC, a venture lending firm, and he is a director of several private companies. He is a graduate of Harvard College and Harvard Law School, where he was an editor of The Harvard Law Review.

Qualifications, Experience, Attributes and Skills. Mr. Golden has over 20 years of technology and finance experience as an investment banker specializing in the technology sector at JPMorgan, Hambrecht & Quist, and more recently as a managing partner and executive of Revolution Ventures and Executive Chairman of Code Advisors LLC. Mr. Golden’s technology experience also includes his service as a director and Advisory Board of Directors member of several technology companies including Blackbaud, Inc., a global provider of software services specifically designed for nonprofit organizations. Mr. Golden’s finance experience at Hambrecht & Quist and JPMorgan included significant work with mergers, capital markets and principal investing, and he has participated as lead merger advisor, equity underwriter or investor on over 150 transactions. Given this experience, Mr. Golden brings to the Board of Directors substantial knowledge of the technology sector and meaningful insight into the financial, strategic and capital-related issues technology companies face.

Michael P. Huseby serves as the Chairman of the Board of Directors and Chief Executive Officer. He was a member of the Board of Directors of Barnes & Noble from January 2014 and served as the Chief Executive Officer of Barnes & Noble until the complete legal and structural separation of the Company from Barnes & Noble on August 2, 2015. He was elected to the Board of Directors of the Company and was appointed Executive Chairman effective August 2, 2015. Effective on September 19, 2017, Mr. Huseby became Chief Executive Officer of the Company in addition to his role as Chairman of the Board of Directors. Previously, Mr. Huseby was appointed President of Barnes & Noble in July 2013, and Chief Financial Officer of Barnes & Noble in March 2012. From 2004 to 2011, Mr. Huseby served as Executive Vice President and Chief Financial Officer of Cablevision Systems Corporation, a leading telecommunications and media company, which was acquired by the Altice Group in June 2016. He served on the Cablevision Systems Corporation Board of Directors in 2000 and 2001. Prior to joining Cablevision, Mr. Huseby served as Executive Vice President and Chief Financial Officer of Charter Communications, Inc., a large cable operator in the United States. Mr. Huseby served on the Board of Directors of Charter Communications from May 2013 through May 2016. Mr. Huseby served as Executive Vice President, Finance and Administration, of AT&T Broadband, a leading provider of cable television services from 1999 to 2002, when it was sold to Comcast Corporation. In addition, Mr. Huseby spent over 20 years at Arthur Andersen, LLP and Andersen Worldwide, S.C., where he held the position of Global Equity Partner serving a myriad of clients, including a number of large publicly-traded companies. Mr. Huseby served on the Board of Directors of CommerceHub, Inc., a cloud basede-commerce fulfillment and marketing software platform company listed on Nasdaq, from July 2016 until May 2018 with his tenure ending upon the consummation of the sale of CommerceHub to financial sponsors. While on the Board of CommerceHub, Mr. Huseby served as chair of the Audit Committee and as a member of the Compensation Committee.

Qualifications, Experience, Attributes and Skills. Mr. Huseby has more than 30 years of financial and executive experience, having served as a senior executive at Barnes & Noble, Cablevision Systems Corporation and AT&T Broadband. Mr. Huseby’s experience also includes his service as a director and audit committee member of Charter Communications and CommerceHub, Inc., and as a member of Cablevision Systems Corporation’s Board of Directors. This experience allows Mr. Huseby to bring to the Board of Directors substantial knowledge and a wide range and depth of insights in technology, retail, financial, business and matters unique to publicly-traded companies.

John R. Ryan was elected to the Board of Directors in July 2015 and currently serves as the Lead Independent Director. Vice Admiral Ryan served as director of Barnes & Noble from July 2014 until theSpin-Off. Vice Admiral Ryan joined the Center for Creative Leadership’s Board of Directors of Governors in 2002 and has served as its President and Chief Executive Officer since 2007. From 2005 to 2007, he served as Chancellor of the State University of New York. Previously, Vice Admiral Ryan served as President of the State University of New York Maritime College from 2002 to 2005, Interim President of the State University of New York at Albany from 2004 to 2005 and Superintendent of the United States Naval Academy, Annapolis, Maryland from 1998 to 2002. Vice Admiral Ryan served in the United States Navy from 1967 until his retirement in 2002, including as Commander of the Fleet Air Mediterranean from 1995 to 1998, Commander of

the Patrol Wings for the United States Pacific Fleet from 1993 to 1995 and Director of Logistics for the US Command from 1991 to 1993. Vice Admiral Ryan is also the lead director of CIT Group, Inc.

Qualifications, Experience, Attributes and Skills. Vice Admiral Ryan has a total of more than 35 years in military service, more than 10 years as a leader at major universities, and over a decade of executive and Board of Directors-level experience, including his service as lead director of CIT Group. Vice Admiral Ryan has substantial experience serving on public company Board of Directors undergoing multiple strategic transactions, such as separations, including serving as a director of Cablevision during its 2010 spinoff of Madison Square Garden, L.P., its 2011 spinoff of AMC Networks, Inc., and its 2013 sales of Clearview Cinemas and Optimum West to Bow Tie Cinemas and Charter Communications, respectively. Vice Admiral Ryan has also gained experience through the acquisition of Cablevision Systems Corporation by the Altice Group in June 2016, and was one of two independent directors on the Special Committee of the Board of Directors involved in the acquisition of MBS Textbook Exchange, LLC. This experience allows Vice Admiral Ryan to bring to the Board of Directors leadership and expertise in managing large complex organizations, and in particular the environment in which the Company operates.

Jerry Sue Thornton was elected as a director in August 2015. Dr. Thornton currently serves as Chief Executive Officer of Dream Catcher Educational Consulting, a consulting firm that provides coaching and professional development for newly selected college and university presidents. She previously served as President of Cuyahoga Community College from 1992 to 2013 (for which she is now President Emeritus). Prior to serving in that role, she was President of Lakewood College in Minnesota from 1985 to 1991. SheDr. Thornton also serves as a director of FirstEnergy Corp., Applied Industrial Technologies, Inc., Parkwood Corporation, a financial planning company headquartered in Cleveland, and RPM International Inc.JobsOhio, the economic development agency for the State of Ohio. She served as a director of American Greetings Corporation from 2000 until it became a private corporation in 2013.2013, and also previously served on the board of American Greetings Corporation, American Family Insurance, FirstEnergy Corporation, National City Corporation, OfficeMax and RPM International Inc.

Qualifications, Experience, Attributes and Skills. Dr. Thornton has extensive executive leadership and management experience in higher education as well as public corporate Board of Directors experience. She served on the Board of Directors of National City Corporation (banking) and American Family Insurance, as well

as other public companies where she served on numerous key Board of Directors committees. Dr. Thornton also served as one of two independent directors on the Special Committee of the Board of Directors involved in the acquisition of MBS Textbook Exchange, LLC. She is a recognized leader in the Northeast Ohio community and the State of Ohio. She has over 40 years of higher education work experience with 32 years in leadership positions. Dr. Thornton brings to the Board of Directors broad leadership and business skills, together with her extensive Board of Directors service for public companies and community organizations.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT YOU VOTEFOR THE ELECTION OF EACH NOMINEE FOR DIRECTOR NAMED ABOVE USING THE ENCLOSED PROXY CARD.

Daniel A. DeMatteo was elected as a director in August 2015. Mr. DeMatteo has served as Gamestop, Inc.’s Director and Executive Chairman since June 2010, and previously held other roles with Gamestop, including Chief Executive Officer from August 2008 to June 2010, Vice Chairman and Chief Operating Officer from March 2005 to August 2008, and President and Chief Operating Officer of Gamestop or its predecessor companies since November 1996. Mr. DeMatteo has served as an executive officer in the video game industry since 1988.

Qualifications, Experience, Attributes and Skills. Mr. DeMatteo brings to the Board of Directors over 25 years of experience as an executive officer, including 19 years of experience growing Gamestop and its predecessor companies into the world’s largest multichannel video game retailer. As one of the founders of Gamestop, Mr. DeMatteo has demonstrated a record of leadership, innovation and achievement. With his experience in the roles of Executive Chairman, Vice Chairman, Chief Executive Officer, President and Chief Operating Officer, Mr. DeMatteo provides the Board of Directors a unique and valuable perspective on corporate operations, strategy and business, including his perspective on the formula for success that has brought Gamestop to its current industry-leading position. The Board of Directors also benefits from Mr. DeMatteo’s entrepreneurial spirit and his extensive network of contacts and relationships within the retail industry.

John R. Ryan was elected to the Board of Directors in July 2015 and currently serves as the Lead Independent Director. Vice Admiral Ryan served as director of Barnes & Noble from July 2014 until theSpin-Off. Vice Admiral Ryan joined the Center for Creative Leadership’s Board of Directors of Governors in 2002 and has served as its President and Chief Executive Officer since 2007. From 2005 to 2007, he served as Chancellor of the State University of New York. Previously, Vice Admiral Ryan served as President of the State University of New York Maritime College from 2002 to 2005, Interim President of the State University of New York at Albany from 2004 to 2005 and Superintendent of the United States Naval Academy, Annapolis, Maryland from 1998 to 2002. Vice Admiral Ryan served in the United States Navy from 1967 until his retirement in 2002, including as Commander of the Fleet Air Mediterranean from 1995 to 1998, Commander of the Patrol Wings for the United States Pacific Fleet from 1993 to 1995 and Director of Logistics for the US Command from 1991 to 1993. Vice Admiral Ryan is also the lead director of CIT Group, Inc. and was a director of Cablevision Systems Corporation from 2002 until it was acquired by the Altice Group in June 2016.

Qualifications, Experience, Attributes and Skills. Vice Admiral Ryan has a total of more than 35 years in military service, more than 10 years as a leader at major universities, and over a decade of executive and Board of Directors-level experience, including his service as lead director of CIT Group. Vice Admiral Ryan has substantial experience serving on public company Board of Directors undergoing strategic transactions, such as separations, including serving as a director of Cablevision during its 2010 spinoff of Madison Square Garden, L.P., its 2011 spinoff of AMC Networks, Inc., and its 2013 sales of Clearview Cinemas and Optimum West to Bow Tie Cinemas and Charter Communications, respectively. Vice Admiral Ryan has also gained experience through the acquisition of Cablevision Systems Corporation by the Altice Group in June 2016, and was one of two independent directors on the Special Committee of the Board of Directors involved in the acquisition of

MBS Textbook Exchange, LLC. This experience allows Vice Admiral Ryan to bring to the Board of Directors leadership and expertise in managing large complex organizations, and in particular the environment in which the Company operates.

Michael P. Huseby was a member of the Board of Directors of Barnes & Noble from January 2014 and served as the Chief Executive Officer of Barnes & Noble until the complete legal and structural separation of the Company from Barnes & Noble on August 2, 2015. He was elected to the Board of Directors of the Company and was appointed Executive Chairman effective August 2, 2015. Effective on September 19, 2017, Mr. Huseby will serve as Chief Executive Officer of the Company in addition to his role as Executive Chairman of the Board of Directors. Previously, Mr. Huseby was appointed President of Barnes & Noble in July 2013, and Chief Financial Officer of Barnes & Noble in March 2012. From 2004 to 2011, Mr. Huseby served as Executive Vice President and Chief Financial Officer of Cablevision Systems Corporation, a leading telecommunications and media company, which was acquired by the Altice Group in June 2016. He served on the Cablevision Systems Corporation Board of Directors in 2000 and 2001. Prior to joining Cablevision, Mr. Huseby served as Executive Vice President and Chief Financial Officer of Charter Communications, Inc., a large cable operator in the United States. Mr. Huseby served on the Board of Directors of Charter Communications from May 2013 through May 2016. Mr. Huseby served as Executive Vice President, Finance and Administration, of AT&T Broadband, a leading provider of cable television services from 1999 to 2002, when it was sold to Comcast Corporation. In addition, Mr. Huseby spent over 20 years at Arthur Andersen, LLP and Andersen Worldwide, S.C., where he held the position of Global Equity Partner serving a myriad of clients, including a number of large publicly-traded companies. Mr. Huseby serves on the Board of Directors of CommerceHub, Inc., a cloud-basede-commerce fulfillment and marketing software platform company listed on Nasdaq.

Qualifications, Experience, Attributes and Skills. Mr. Huseby has more than 20 years of financial and executive experience, having served as a senior executive at Barnes & Noble, Cablevision Systems Corporation and AT&T Broadband. Mr. Huseby’s experience also includes his service as a director and audit committee member of Charter Communications and CommerceHub, Inc., and as a member of Cablevision Systems Corporation’s Board of Directors. This experience allows Mr. Huseby to bring to the Board of Directors substantial knowledge and a wide range and depth of insights in technology, retail, financial, business and matters unique to publicly-traded companies.

David A. Wilson was elected to the Board of Directors in July 2015. Dr. Wilson served as a director of Barnes & Noble from October 2010 until theSpin-Off. From 1995 to December 2013, Dr. Wilson served as President and Chief Executive Officer of the Graduate Management Admission Council, anot-for-profit education association dedicated to creating access to graduate management and professional education that provides the Graduate Management Admission Test (GMAT). In 1995, as CEO of the GMAT, Dr. Wilson took the paper and pencil test to a computer delivered test worldwide and was the first person to do so. From 2009 to 2010, Dr. Wilson was a director of Terra Industries Inc., a producer and marketer of nitrogen products, where he was a member of the audit committee. From 2002 to 2007, Dr. Wilson was a director of Laureate Education, Inc. (formerly Sylvan Learning Systems, Inc.), an operator of an international network of licensed campus-based and online universities and higher education institutions, where he was chairman of the audit committee beginning in 2003. From 1978 to 1994, Dr. Wilson was employed by Ernst & Young LLP (and its predecessor, Arthur Young & Company), serving as an Audit Principal through 1981, as an Audit Partner from 1981 to 1983 and thereafter in various capacities including Managing Partner, National Director of Professional Development, Chairman of Ernst & Young’s International Professional Development Committee and as a director of the Ernst & Young Foundation. From 1968 to 1978, Dr. Wilson served as a faculty member at Queen’s University

(1968-1970), the University of Illinois at Urbana-Champaign (1970-1972), the University of Texas (1972-1978), where he was awarded tenure, and Harvard Business School (1976-1977). Dr. Wilson is also on the Board of Directors of CoreSite Realty Corporation, a publicly-traded real estate investment trust, and serves as lead director chairand as a member of the audit committee and a member of the compensation committee. In November 2015, he was elected as Trustee of Johnson & Wales University, anot-for-profit institution, and serves as chair of its audit committee and as a member of its finance and budget committee. Dr. Wilson is a National Association of Corporate Directors (NACD) Governance Leadership Fellow (the highest award they give) and received the CERT Certificate in Cybersecurity Oversight awarded by the Software Engineering Institute of Carnegie Mellon University. He was also a 2015 honoree of the NACD Directorship 100 award in recognition of exemplary board leadership.

Qualifications, Experience, Attributes and Skills. Dr. Wilson has a total of more than 30 years of executive and Board of Directors-level experience, including serving on the Board of Directors of Terra Industries Inc. and Laureate Education, Inc. while those companies were involved in multiple strategic transactions, as well as serving as President and Chief Executive Officer of the Graduate Management Admission Council. Dr. Wilson also has more than 16 years of financial and accounting expertise, including as an Audit Partner at Ernst & Young LLP (and its predecessor, Arthur Young & Company). This experience allows Dr. Wilson to bring to the Board of Directors substantial financial and accounting knowledge and valuable insights.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT YOU VOTEFOR THE ELECTION OF EACH NOMINEE FOR DIRECTOR NAMED ABOVE USING THE ENCLOSED PROXY CARD.

Meetings and Committees of the Board of Directors

The Board of Directors met ten (10) times during the Company’s fiscal year 2017,2019, which ended April 29, 201727, 2019 (“Fiscal 2017”2019”). All directors attended at least 75% of all meetings of the Board of Directors and committees of which he or she was a member.

Based on information supplied to it by the directors, the Board of Directors has affirmatively determined that each of Emily C. Chiu, Daniel A. DeMatteo, David G. Golden, John R. Ryan, Jerry Sue Thornton, and David A. Wilson is “independent” under the listing standards of the NYSE, and has made such determinations based on the fact that none of such persons have had, or currently have, any relationship with the Company or its affiliates or any executive officer of the Company or his or her affiliates, that would currently impair their independence, including, without limitation, any such commercial, industrial, banking, consulting, legal, accounting, charitable or familial relationship.

The Board of Directors has three standing committees: the Audit Committee, the Compensation Committee, and the Corporate Governance and Nominating Committee. The Board of Directors also formed a special committee in 2016 to review and evaluate a potential business combination with MBS Textbook Exchange, LLC (the “Special Committee”) which was completed in Fiscal 2017.

Audit Committee. The responsibilities of the Audit Committee include, among other duties:

overseeing the quality and integrity of our financial statements, accounting practices and financial information we provide to the SECSecurities and Exchange Commission (“SEC”) or the public;

reviewing our annual and interim financial statements, the report of our independent registered public accounting firm on our annual financial statements, Management’s Report on Internal Control over Financial Reporting and the disclosures under Management’s Discussion and Analysis of Financial Condition and Results of Operations;

selecting and appointing an independent registered public accounting firm;

pre-approving all services to be provided to us by our independent registered public accounting firm;

reviewing with our independent registered public accounting firm and our management the accounting firm’s significant findings and recommendations upon the completion of the annual financial audit and quarterly reviews;

reviewing and evaluating the qualification, performance, fees and independence of our registered public accounting firm;

meeting with our independent registered public accounting firm and our management regarding our internal controls, critical accounting policies and practices, and other matters;

discussing with our independent registered public accounting firm and our management earnings releases prior to their issuance;

overseeing the Company’sour enterprise risk assessment and management;

overseeing our internal audit function;

reviewing and approving related party transactions (see “Certain Relationships and Related Transactions” below); and

overseeing our compliance program, response to regulatory actions involving financial, accounting and internal control matters, internal controls and risk management policies.

The Board of Directors has adopted a written charter setting out the functions of the Audit Committee, a copy of which is available on the Company’s website atwww.bned.com and is available in print to any stockholder who requests it in writing directed to the Company’s Corporate Secretary, Barnes & Noble Education, Inc., 120 Mountain View Blvd., Basking Ridge, New Jersey 07920.

The members of the Audit Committee currently are Dr. David A. Wilson (Chair), Emily C. Chiu, Daniel A. DeMatteo and David G. Golden. In addition to meeting the independence standards of the NYSE listing standards, each member of the Audit Committee meets the independence standards established by the SEC for audit committee members and our Corporate Governance Guidelines. The Board of Directors has also determined that each of Dr. Wilson, Ms. Chiu, Mr. DeMatteo and Mr. Golden is financially literate for purposes of the NYSE listing standards and has the requisite attributes of an “audit committee financial expert” as defined by regulations promulgated by the SEC and that such attributes were acquired through relevant education and/or experience. The Audit Committee met eight (8)seven (7) times during Fiscal 2017.2019.

Compensation Committee. The responsibilities of the Compensation Committee include, among other duties:

setting and reviewing our general policy regarding executive compensation;

determining the compensation of our Chief Executive Officer and other executive officers;

approving employment agreements for our Chief Executive Officer and other executive officers;

reviewing the benefits provided to our Chief Executive Officer and other executive officers;

overseeing our overall compensation structure, practices and benefit plans;

administering our executive bonus and equity-based incentive plans; and

assessing the independence of compensation consultants, legal counsel and other advisors to the Compensation Committee and hiring, approving the fees and overseeing the work of, and terminating the services of such advisors.

The Board of Directors has adopted a written charter setting out the functions of the Compensation Committee, a copy of which is available on the Company’s website atwww.bned.com and is available in print to any stockholder who requests it in writing directed to the Company’s Corporate Secretary, Barnes & Noble Education, Inc., 120 Mountain View Blvd., Basking Ridge, New Jersey 07920.

The members of the Compensation Committee currently are David G. Golden (Chair), Daniel A. DeMatteo, Vice Admiral John R. Ryan and Dr. Jerry Sue Thornton. All members of the Compensation Committee meet the independence standards of the NYSE listing standards and our Corporate Governance Guidelines. The members of the Compensation CommitteeGuidelines and are“non-employee directors” (withinwithin the meaning of Rule16b-3 under the Securities Exchange Act) and “outside directors” (within the meaning of Section 162(m) of the Internal Revenue Code (the “Code”)).

Act. The Compensation Committee met six (6)five (5) times during Fiscal 2017.2019. The Compensation Committee has engaged Mercer, an independent consulting firm, to provide information, analyses and advice regarding executive compensation and other matters. For further discussion of the nature and scope of the independent compensation consultant’s assignment, see the “Compensation Discussion and Analysis-Roles of the Compensation Committee, Management, and our Compensation Consultant in Determining the Compensation of our Named Executive Officers-Role of the Compensation Consultant” section of this Proxy Statement.

Corporate Governance and Nominating Committee. The responsibilities of the Corporate Governance and Nominating Committee include, among other duties:

overseeing our corporate governance practices;

reviewing and making recommendations to our Board of Directors regarding the structure of our various Board of Directors committees;

identifying, reviewing and recommending to our Board of Directors individuals for election to the Board of Directors;

adopting and reviewing policies regarding the consideration of Board of Directors candidates proposed by stockholders and other criteria for Board of Directors membership; and

overseeing our Board of Directors’ annual self-evaluation.

The Board of Directors has adopted a written charter setting out the functions of the Corporate Governance and Nominating Committee, a copy of which is available on the Company’s website atwww.bned.com and is available in print to any stockholder who requests it in writing directed to the Company’s Corporate Secretary, Barnes & Noble Education, Inc., 120 Mountain View Blvd., Basking Ridge, New Jersey 07920.

The members of the Corporate Governance and Nominating Committee currently are Vice Admiral John R. Ryan (Chair), Emily C. Chiu, Dr. Jerry Sue Thornton and Dr. David A. Wilson.

The Corporate Governance and Nominating Committee consists entirely of independent directors, each of whom meet the independence requirements set forth in the listing standards of the NYSE and our Corporate Governance Guidelines. The Corporate Governance and Nominating Committee met four (4) times during Fiscal 2017.

Special Committee. On January 27, 2016, the Board of Directors approved the formation of the Special Committee consisting of Dr. Jerry Sue Thornton and Vice Admiral John R. Ryan, each an independent and disinterested member of the Board of Directors, to review and evaluate the potential acquisition of MBS Textbook Exchange, LLC (“MBS”), which was owned by a significant stockholder of the Company. The Special Committee, with the assistance of its independent legal and financial advisors, negotiated the terms of the purchase agreement and made a recommendation to the Board of Directors regarding the related party transaction, as described in more detail under “Certain Relationships and Related Transactions - Related Party Transactions” on page 42. The Special Committee met approximately 15 times during Fiscal 2017, in addition to its members participating in numerous calls ande-mail correspondence to discuss and analyze the transaction.2019.

Compensation Committee Interlocks and Insider Participation

None of the members of the Compensation Committee havehas ever been an employee of the Company, and none of them had a relationship requiring disclosure in this Proxy Statement under Item 404 of SEC RegulationS-K. None of the Company’s executive officers serve, or in Fiscal 20172019 served, as a member of the Board of Directors or compensation committee of any entity that has one or more of its executive officers serving as a member of the Company’s Board of Directors or the Company’s Compensation Committee.

Director Qualifications and Nominations

The Company does not set specific criteria for directors except to the extent required to meet applicable legal, regulatory and stock exchange requirements, including, but not limited to, the independence requirements of the NYSE listing standards and the SEC, as applicable. Nominees for director will be selected on the basis of outstanding achievement in their personal careers, board experience, wisdom, integrity, ability to make

independent and analytical inquiries, understanding of the business environment, and willingness to devote adequate time to Board of Directors duties. While the selection of qualified directors is a complex and subjective process that requires consideration of many intangible factors, the Corporate Governance and Nominating Committee believes that each director should have a basic understanding of (a) the principal operational and financial objectives and plans and strategies of the Company, (b) the results of operations and financial condition of the Company and of any significant subsidiaries or businesses, and (c) the relative standing of the Company and its businesses in relation to its competitors.

The Company does not have a specific policy regarding the diversity of the Board of Directors. Instead, the Corporate Governance and Nominating Committee considers the Board of Directors’ overall composition when considering director candidates, including whether the Board of Directors has an appropriate combination of professional experience, skills, knowledge and variety of viewpoints and backgrounds in light of the Company’s current and expected future needs. In addition, the Corporate Governance and Nominating Committee also believes that it is desirable for new candidates to contribute to a variety of viewpoints on the Board of Directors, which may be enhanced by a mix of different professional and personal backgrounds and experiences.

Although the process for identifying and evaluating candidates to fill vacancies and/or reduce or expand the Board of Directors will inevitably require a practical approach in light of the particular circumstances at such time, the Board of Directors has adopted the following process to guide the Corporate Governance and Nominating Committee in this respect. The Corporate Governance and Nominating Committee is willing to consider candidates submitted by a variety of sources (including incumbent directors, stockholders (as described below), Company management and independent third-party search firms) when reviewing candidates to fill vacancies and/or expand the Board of Directors. If a vacancy arises or the Board of Directors decides to expand its membership, the Corporate Governance and Nominating Committee may ask each director to submit a list of potential candidates for consideration. The Corporate Governance and Nominating Committee then evaluates each potential candidate’s educational background, employment history, outside commitments and other relevant factors to determine whether he or she is potentially qualified to serve on the Board of Directors. At that time, the Corporate Governance and Nominating Committee also will consider potential nominees submitted by stockholders, if any, in accordance with the procedures described below, or by the Company’s management and, if the Corporate Governance and Nominating Committee deems it necessary, retain an independent third-party search firm to provide potential candidates. The Corporate Governance and Nominating Committee seeks to identify and recruit the best available candidates, and it intends to evaluate qualified stockholder nominees on the same basis as those submitted by Board of Directors members, Company management, independent third-party search firms or other sources.

After completing this process, the Corporate Governance and Nominating Committee will determine whether one or more candidates are sufficiently qualified to warrant further investigation. If the process yields one or more desirable candidate(s), the Corporate Governance and Nominating Committee will rank them by order of preference, depending on their respective qualifications and the Company’s needs. The Corporate Governance and Nominating Committee Chair will then contact the preferred candidate(s) to evaluate their potential interest and to set up interviews with the full Corporate Governance and Nominating Committee. All such interviews include only the candidate and one or more Corporate Governance and Nominating Committee members. Based upon interview results and appropriate background checks, the Corporate Governance and Nominating Committee then decides whether it will recommend the candidate’s nomination to the full Board of Directors.

When nominating a sitting director forre-election, the Corporate Governance and Nominating Committee will consider the director’s performance on the Board of Directors and its committees and the director’s qualifications in respect of the criteria referred to above.

Consideration of Stockholder-Nominated Directors

In accordance with its charter, the Corporate Governance and Nominating Committee will consider candidates for election to the Board of Directors at a stockholder meeting if submitted by aan eligible stockholder in a timely manner. Any eligible stockholder wishing to submit a candidate for consideration for election at a stockholder meeting should send the following information to the Company’s Corporate Secretary, Barnes & Noble Education, Inc., 120 Mountain View Blvd., Basking Ridge, New Jersey 07920.

Stockholder’s name, number of shares owned, length of period held, and proof of ownership;

Name, age and address of candidate;

A detailed resume describing, among other things, the candidate’s educational background, occupation, employment history for at least the previous five years, and material outside commitments (e.g., memberships on other Board of Directors and committees, charitable foundations, etc.);

A supporting statement which describes the candidate’s reasons for seeking election to the Board of Directors;

A description of any arrangements or understandings between the candidate and the Company and/or the stockholder; and

A signed statement from the candidate, confirming his/her willingness to serve on the Board of Directors.

In accordanceEligible stockholders who do not wish to follow the foregoing procedure but who wish instead to nominate directly one or more persons for election to the Board of Directors must comply with the charterprocedures established by our bylaws. Our bylaws provide that in order to nominate a person for election as a director at next year’s annual meeting, a notice of an intention to nominate one or more directors containing certain information required by the bylaws must be delivered to the Corporate Secretary of the Corporate Governance and Nominating Committee,Company. To be timely, whether or not a stockholder wishes to have his or her nominees included in order forthe Company’s proxy materials, the Corporate Governance and Nominating Committee to consider a candidate submitted by a stockholder for election at a stockholder meeting,Secretary of the Company must receive the foregoing information not less than 90 days, nor more than 120 days, priornominations for election to such meeting. The Company’s Corporate Secretary will promptly forward such materials to the Corporate Governance and Nominating Committee. The Company’s Corporate Secretary also will maintain copies of such materials for future reference by the Corporate Governance and Nominating Committee when filling Board of Directors positions.for its 2020 annual meeting of stockholders at Barnes & Noble Education, Inc., 120 Mountain View Blvd., Basking Ridge, New Jersey 07920 no earlier than May 28, 2020 and no later than June 27, 2020. For more information on stockholder proposals, see “Stockholder Proposals” on page 50.

Additionally, the Corporate Governance and Nominating Committee will consider stockholder nominated candidates if a vacancy arises or if the Board of Directors decides to expand its membership, and at such other times as the Corporate Governance and Nominating Committee deems necessary or appropriate. In any such event, any stockholder wishing to submit a candidate for consideration should send the above-listed information to the Company’s Corporate Secretary, Barnes & Noble Education, Inc., 120 Mountain View Blvd., Basking Ridge, New Jersey 07920.

All seven of the director nominees identified in this Proxy Statement currently serve as directors of the Company and all have been recommended by our Corporate Governance and Nominating Committee to our Board of Directors forre-election. The Corporate Governance and Nominating Committee recommends candidates to the full Board of Directors after receiving input from all directors. The Corporate Governance and Nominating Committee members, other members of the Board of Directors and senior management discuss potential candidates during this search process.

Certain Board of Directors’ Policies and Practices

Corporate Governance Guidelines and Code of Business Conduct and Ethics

The Board of Directors has adopted Corporate Governance Guidelines applicable to the members of the Board of Directors. The Board of Directors has also adopted a Code of Business Conduct and Ethics applicable to the Company’s employees, directors, agents and representatives, including consultants. The Corporate Governance Guidelines and the Code of Business Conduct and Ethics are available on the Company’s website atwww.bned.com. Copies of the Corporate Governance Guidelines and the Code of Business Conduct and Ethics are available in print to any stockholder who requests them in writing to the Company’s Corporate Secretary, Barnes & Noble Education, Inc., 120 Mountain View Blvd., Basking Ridge, New Jersey 07920.

Board of Directors Leadership Structure; Lead Independent Director

TheMr. Huseby currently serves as the Chairman of the Board of Directors, or the Executive Chairman, is selected by the members of the Board of Directors, and may or may not be an officer of the Company. Currently, Mr. Huseby, an officer of the Company, serves as the Executive Chairman. Prior to the resignation of Mr. Roberts, the positions of the

Executive Chairman and Chief Executive Officer (“CEO”) were separate,of the Company. The roles of CEO and Mr. Roberts reported directly to the Executive Chairman while Mr. Huseby reported directly toof the Board of Directors. The Board of Directors determined that the structure was appropriate at that time, in that it enabled Mr. Roberts to focus on his role as CEO of the Company while enabling Mr. Huseby to continue to provide leadership on policy at the Board of Directors level. No formal policy exists requiring such separation.

Following Mr. Roberts’ resignation andwere combined following Mr. Huseby’s appointment to the position of CEO, effective September 19, 2017, the roles of CEO and Executive Chairman will be combined.2017. The Company believes that a combined CEO and Executive Chairman role is appropriate because it provides an efficient and effective leadership structure for the Company following Mr. Roberts’ departure.Company. It promotes alignment between the Board of Directors and management on the Company’s strategic objectives, facilitates effective presentation of information to enable the Board of Directors to fulfill its responsibilities, and allows for productive and effective Board of Directors’ meetings. The Board of Directors believes that the right Board of Directors leadership structure should, among other things, be determined by the needs and

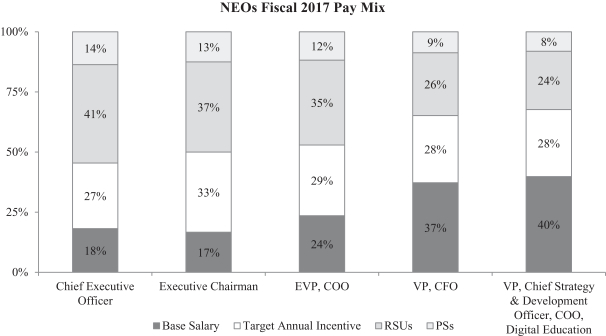

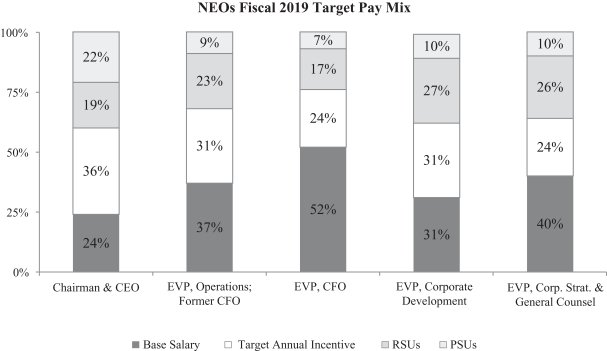

circumstances of the Company and the then current membership of the Board of Directors, and that the Board of Directors should remain adaptable to shaping the leadership structure as those needs and circumstances change.